Roth Recharaterizations are no longer part of the tax code.

For a description of how this changes this Roth conversion strategy, read “No Roth Recharacterizations After 2017?”

We recommend a lot of Roth conversions here at Marotta Wealth Management. I feel confident calling us Roth conversion experts.

We’ve been told by our Schwab representatives that there is no one who does Roth conversions quite like we do. While most investment advisors do one total conversion or partial conversion here or there, we have a dedicated Roth segregation strategy, which adds real value to our clients accounts.

Let’s imagine that you have two securities YING and YANG which perform opposite one another around the same mean return. They have the mean inflation-adjusted return of 3.91%. So when YANG experiences -11.28% return (15.19% below) then YING would experience a 19.10% return (15.19% above). Thus, so long as you have the same dollar amount invested in YING and YANG, you would always experience the mean inflation-adjusted return of 3.91%.

You are in the Virginia state tax rate of 5.75%, the federal income tax rate of 25%, and the federal capital gains rate of 15%. You have a Traditional IRA worth $1,000,000 and a brokerage account worth $1,000,000, both of which have a 50% 50% YING YANG asset allocation, so they experience the mean inflation-adjusted return of 3.91% each year.

Every year, you convert two conversion accounts worth $50,000, one invested entirely in YING and the other invested entirely in YANG. Then, after waiting for them to go either up or down, you recharacterize the one that went down back into your Traditional IRA and consolidate the one that went up into your Roth IRA.

Each year, you always get the mean inflation-adjusted return of 3.91%, but you consolidate into your Roth whichever segregation (YING or YANG) has a higher return. Thus, your Roth IRA gets a little bit more return from the consolidation while your Traditional IRA gets a little bit less from the recharacterization.

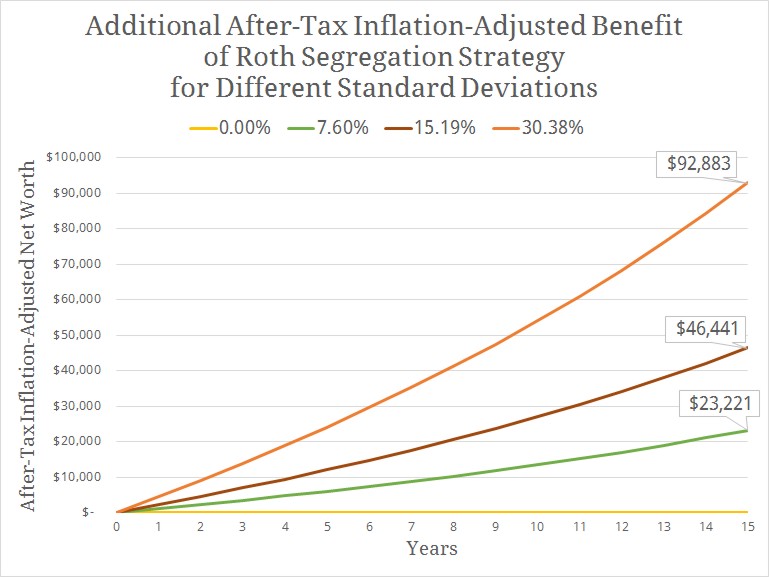

The value of this varies based on time frame and the volatility of YING and YANG, but here is a graph showing the additional after-tax inflation-adjusted value of the Roth segregation strategy for various standard deviations after 15 years over a standard deviation of 0%.

For a standard deviation of 15.68%, the Roth segregation strategy is worth $46,441 in today’s dollars. That is well worth the time it takes to sign the additional paperwork to set-up the additional accounts.

Photo by Brooke Lark on Unsplash