In addition to our “Comprehensive” and “Collaborative” service levels, we offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management with accounts custodied at Charles Schwab. Some additional services are available for an additional charge.

In addition to our “Comprehensive” and “Collaborative” service levels, we offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management with accounts custodied at Charles Schwab. Some additional services are available for an additional charge.

If any of your investments in a taxable account were sold during the year, you must report your capital gain or loss to the IRS on Schedule D. Regardless of whether you are making trades yourself or you have a financial advisor making trades for you, it is difficult to keep track of net realized gains throughout the year.

After the new year and before the tax filing deadline, Schwab will issue their official tax reporting which they share with the IRS containing the final numbers for tax filing, but sometimes you may want to check in on your current running total of net capital gains during the current tax year.

Luckily, there is a page on Schwab Alliance which shows you just that.

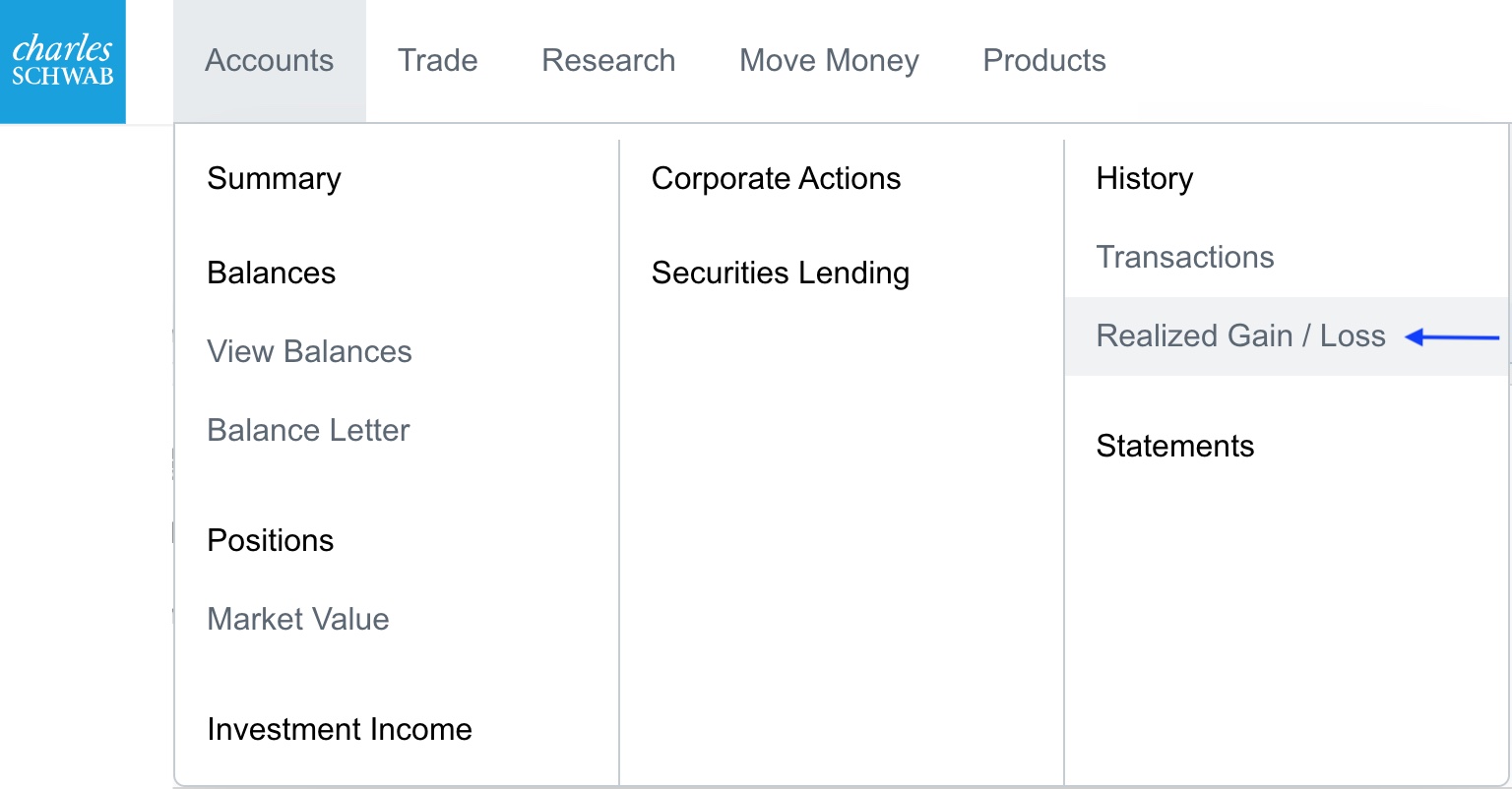

After logging in to Schwab Alliance at https://www.schwab.com, click on the “Accounts” tab at the top and select “Realized Gain / Loss”.

The page that loads will default to showing “All Brokerage Accounts,” which means every account you have at Schwab including retirement accounts, and to the date range of “Year to date,” meaning the current tax year.

To change the account, you can click the blue drop down menu and select just the accounts you are interested in. If you have made account groups, you can also select one of those.

The default page has multiple sections. The first table lists a summary of each account’s total gain/loss realized and then totals them together at the bottom. As only taxable accounts have their realized capital gains taxed, the total summary of all accounts is normally a useless number if you also have tax-sheltered accounts like retirement accounts.

However, looking at the total realized gain/loss of each taxable account is useful.

If you need to send the information to your tax preparer or want to do further analysis with these numbers, you can either click the Export button in the upper right corner to download a CSV version of the information on the page or the Print button to load a printer friendly version of the page.

If you run into any trouble using this tool or need more help interpreting the information you find, it is always best to call Schwab Alliance at 800-515-2157 and speak with a Schwab Alliance team member directly.

Photo by NordWood Themes on Unsplash