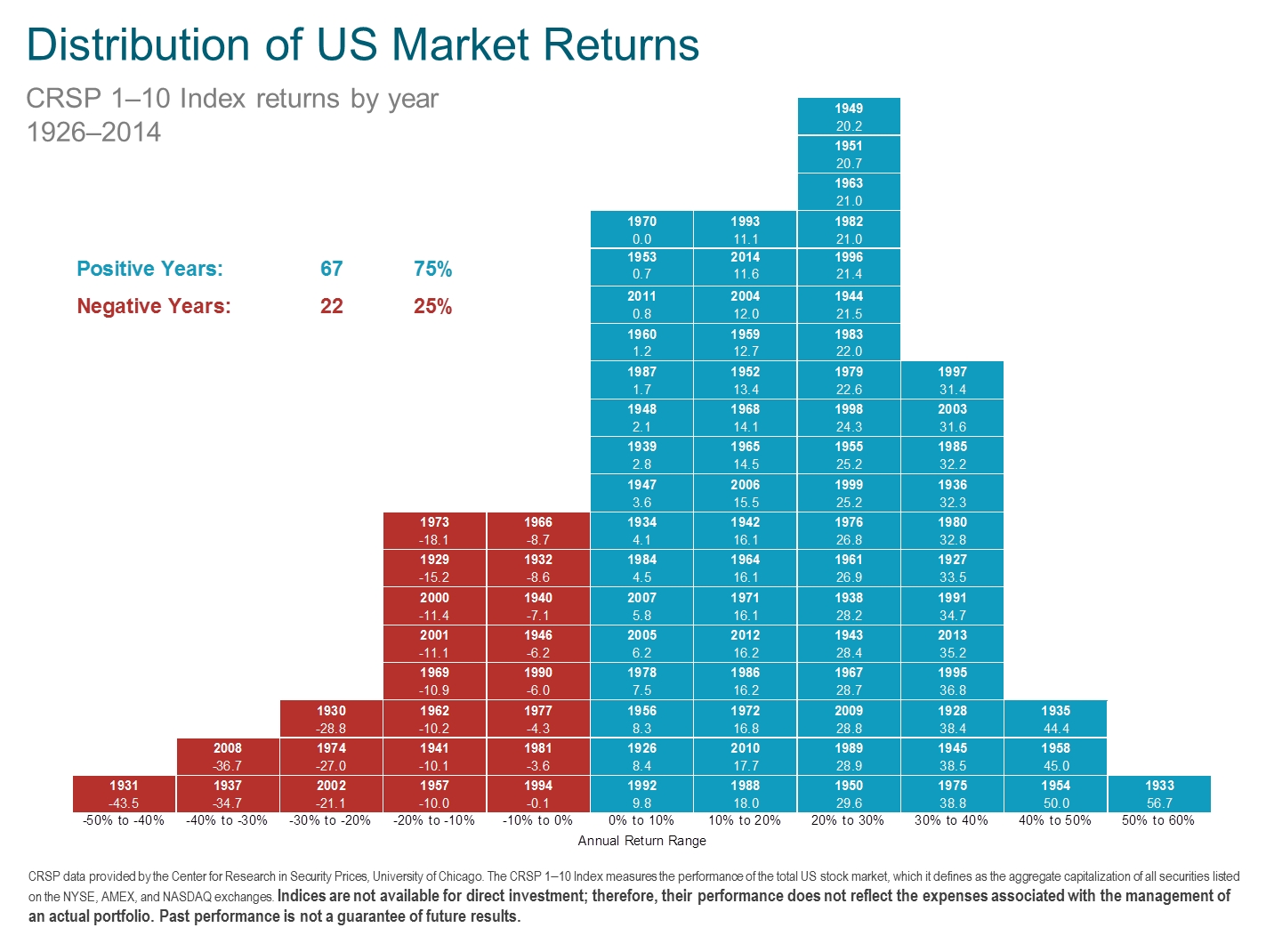

The stock market is inherently volatile, but it is more likely to go up than down. Defining “the stock market” as the aggregate capitalization of all the securities listed on the NYSE, AMEX and NASDAQ exchanges, there have been only 22 years out of 89 in which the markets were down. That means that about 75% of the time, the year ends with the stock market gaining money.

Those are good odds and a good reason to remain invested even after a year in which the markets went down.

But how volatile are the markets really?

Of the 22 down years, 14 ended down over 10%. That means that the market has lost 10% or more in only about 15% of years, about one in six. The odds of the market being down more than 20% are 6.7% (6 out of 89), less than once every 15 years. We’ve had two of these in the last 15 years: 2002 when the markets were down -21.1% and 2008 when the markets were down -36.7%.

People often quote the average return in the US markets as 10% to 12%. But out of the 89 years of returns studied, only three (1993, 2004 and 2014) have had returns between 10% and 12%. More frequently, the markets gained 20% to 30%.

Market volatility is a fact of investing, but one bad year (or even several) should not keep you out of the markets.

1931 is a good example year. It was the worst year for the US markets in history, losing 43.5%, but just two years later, 1933 was the best year in history, gaining 56.7%.

We tend to feel bad news more strongly and there are many people who profit off of stoking investors’ fears or guaranteeing false security. The reality is that the market is more volatile than most people think and it typically goes higher more frequently than people think.

Here is a graph from Dimensional Funds of the data studied:

Photo used here under Flickr Creative Commons.