In an article called, “Does Market Timing Work?

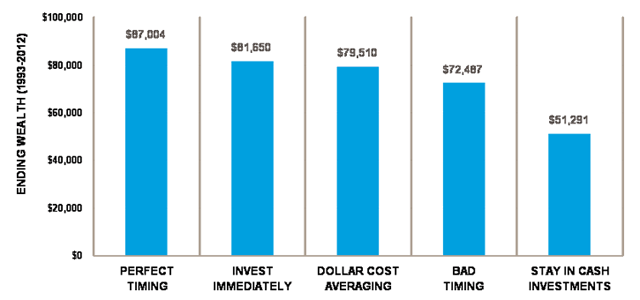

” Mark Riepe of Schwab and his team did some research on what happens over 20 years if you have $2,000 a year to invest (or to not invest), and what happens when you make different choices with that money.

In an article called, “Does Market Timing Work?

” Mark Riepe of Schwab and his team did some research on what happens over 20 years if you have $2,000 a year to invest (or to not invest), and what happens when you make different choices with that money.

The researchers analyzed 68 20-year periods, from 1926 until 2012. It was particularly interesting to me to read that:

Regardless of the time period considered, the rankings turn out to be remarkably similar…. In 58 of the 68 periods, the rankings were exactly the same; that is, Peter Perfect was first, Ashley Action second, Matthew Monthly third, Rosie Rotten fourth and Larry Linger last.

But what about the 10 periods when the results were not as expected? Even in these periods, investing immediately never came in last. It was in its normal second place four times, third place five times and fourth place only once, from 1962 to 1981, one of the few periods of persistently weak equity markets. What’s more, during that period, fourth, third and second places were virtually tied.

The bottom line for the average investor is this: when you have money to invest, invest it, instead of trying to wait for the “perfect” opportunity. Trying to wait until market conditions are perfect likely means you will miss a good investing opportunity.

By perpetually waiting for the “right time,” Larry sacrificed $21,196 compared to even the worst market timer, who invested in the market at each year’s high.

Don’t procrastinate: make a saving and investing plan, and then stick to that plan. You will be better off in the long run than if you hope it all works out, or wait years for the perfect opportunity.

Photo used with permission under Flickr Creative Commons license.