I read with interest this section of Craig L. Israelsen’s article, The Rebalancing Premium, from Financial Planning magazine:

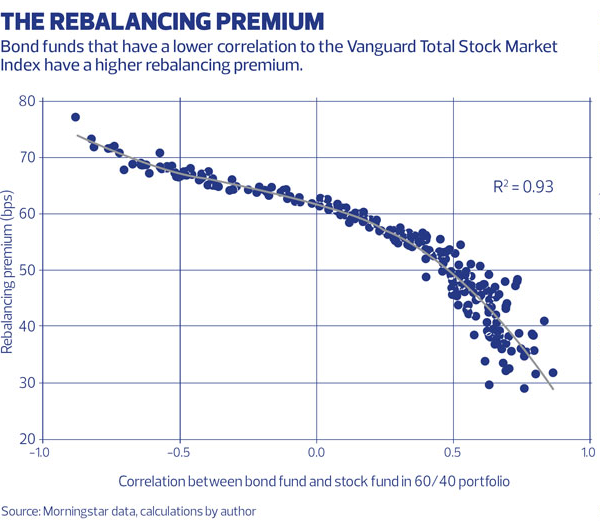

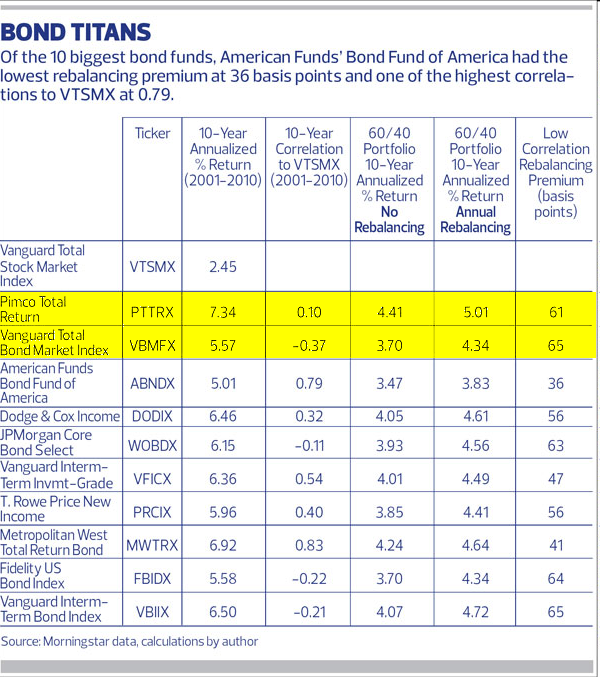

A 60/40 portfolio comprised of 60% VTSMX and 40% VBMFX achieved a 10-year annualized return of 3.7%, assuming each position wasn’t rebalanced over the 10 years. If, however, this two-asset portfolio was rebalanced to 60/40 allocations at the end of each year, the 10-year annualized return was 4.35% – demonstrating the rebalancing premium. In this case, it was 65 basis points. It turns out that the size of a rebalancing premium is related directly to the correlation between the two assets; not all bond funds are created equal.

I’ve written previously to explain how and why the rebalancing bonus is dependent on both the correlation and the volatility of the two asset classes being kept in balance. In fact this idea is the basis for how having an asset allocation target and periodic rebalancing back toward those targets can both boost returns and reduce volatility.

The most interesting portion of the article looked at the bond funds with the lowest correlation and the highest rebalancing bonus over the past 10 years. Among the best included Primco Total Return (PTTRX) which we use as well as Vanguard Total Bond Market Index (VBMFX, BND) in our gone-fishing portfolio:

It is also important to remember that these same principles apply when you are working with asset classes which are not just US stock and US Bonds.

Set your asset allocation targets today so that you can receive a rebalancing bonus going forward.