Once you have opened and funded a health savings account (HSA) with Fidelity, you are ready to begin investing.

Once you have opened and funded a health savings account (HSA) with Fidelity, you are ready to begin investing.

Unlike some other HSA custodians, the beauty of using the Fidelity HSA is you don’t have to open a second account for the purpose of investing your HSA funds. Your cash and investment components can all be held in one account. As soon as the cash from your contribution is in the account, you are ready to invest it.

We generally recommend that you keep enough cash available in your HSA to cover your health insurance deductible for one year, especially if you are actively using your HSA to pay for medical expenses. However, this may not be necessary if you have other emergency savings sufficient to cover any unexpected medical expenses and do not plan on spending from your HSA in the near future.

Fidelity has no minimum cash balance requirement, so there is no barrier to having your HSA fully invested in stocks if you don’t plan to spend from your account until retirement.

For the portion of your HSA that you’d like to invest, we recommend investing your HSA assets according to the 100% Stock recommendation of our latest gone-fishing portfolio.

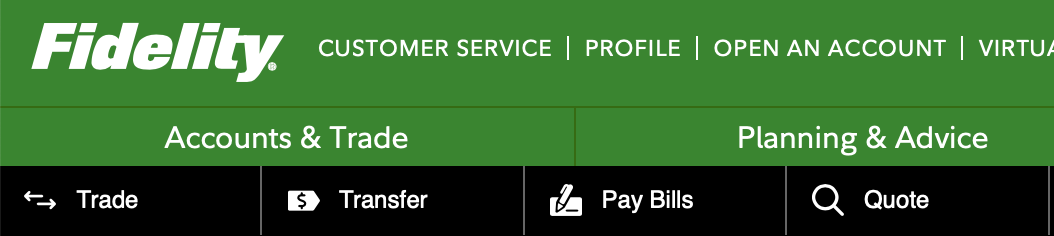

To get started, click on “Trade” in the top menu on the left hand side of the screen.

That will open a pop-up menu where you can enter the various purchases one at a time. If you have multiple accounts with Fidelity, make sure that the correct account is selected under the “Account” drop down menu.

Fidelity also has a share calculator that you can use to help you determine how many shares of each investment to purchase. Simply enter the dollar amount as indicated by our gone-fishing portfolio calculator and let Fidelity compute how many shares to purchase.

Unfortunately, Fidelity currently does not have a method to rebalance HSAs automatically. As such, we recommend rebalancing back to the target asset allocation annually either when the new gone-fishing portfolio is published or in May.

If you need help with the Fidelity website, you can contact them directly at 800-544-6666.

Photo by Toa Heftiba on Unsplash. Image has been cropped.