When you purchase shares of stock of a publicly owned company, you are hoping that the company’s value, and thus the stock price, will go up. Later you can sell your stock, if desired, and make a profit. If you hold a stock position for at least a year before selling, the growth is called a long-term capital gain.

Like other sources of income, when you sell for a capital gain (as opposed to a loss), you are taxed. And like most other tax rates, the capital gains tax is scheduled to go up in 2013.

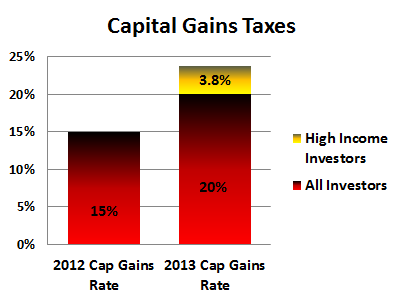

Currently all capital gains are taxed at 15%. This rate applies to all investors, whether you invest $100 or $1,000,000.

Starting in 2013, pending further legislation, the capital gains tax will go up to 20%. Almost all tax brackets are scheduled to go up next year, so the brackets will change to these: 15, 25, 28, 36, and 39.6% of earned income will be paid in taxes. For those in the 28, 36, and 39.6% brackets, itemized deductions will be phased out, which increases the taxes people in these brackets pay overall.

For those in the highest tax bracket (with income over $200,000 if single; $250,000 if married filing jointly), an additional Medicare tax of 3.8% will be levied.

This means that for all investors with earned plus unearned income under the $200,000/ $250,000 threshold, capital gains taxes will be 20%, while investors over these thresholds effectively pay 23.8%.

While the change in capital gains taxes is not as drastic as the dividend tax increase, it is still an increase that may change investors’ behavior. Many are considering realizing capital gains in 2012, paying taxes on them at this year’s lower rate, and plan to save capital losses for 2013 to benefit from the tax advantages of lowering income in a high-tax environment.

We encourage you to talk to your financial advisor and CPA about your strategy for 2012 and 2013. You may need to think slightly differently about capital gains and dividends as tax rates climb.

4 Responses

liz sharpe

Capital gains are not taxed at all for 2012 and years before IF you are in lowest 2 tax brackets, holding

assets longer for one year. It’s ONLY in the 25% bracket and above that gains are taxed at 15%.

Austin Johnston

Hi Liz,

You are correct. Taxpayers in the lowest two tax brackets this year have a 0% capital gains tax. And starting in 2013, taxpayers in the 15% tax bracket will pay a 10% capital gains tax, with those in higher brackets paying 20%.

Elizabeth Sharpe

Thanks for responding. I was impressed.

Will you be changing the incorrect information in your article as I know a lot of people

read Marotta.

Dale

Austin, If I can stay below the 15% tax bracket, will capital gains on real estate be 10%?