Correlation is a measure of how similarly two investments perform. When both go up or down together, that means those securities a correlation of 1.00.

High correlation in a portfolio means it will be extremely volatile, since either everything will go up or everything will go down. It is wise to choose weakly-correlated investments to bring your portfolio’s volatility down to a desirable level.

Researching the correlation of different types of investments helps determine what securities belong to which asset class and from that, how much of which stocks to include in a well-balanced portfolio.

Asset categories whose correlation drops below 0.85 can provide a significant benefit to portfolio construction. For reference, most stock index returns have a relatively high positive correlation to each other, often between 0.85 and 1.00, but are still beneficial.

Historical correlations can rise and fall making the science of which indexes belong together in the same asset class more of an art. Complicating matters, correlations on most stock indexes often approach 1.00 during times of market turmoil.

We’ve seen in previous articles that the correlation between US stocks and foreign stocks can drop low enough to justify assigning these indexes to different asset classes. This is especially true of the correlation between US stocks and emerging market stocks. We’ve also seen that the correlation between styles within US stocks such as large, mid, and small or value and growth are highly correlated, suggesting that these indexes belong as sub-categories within the same asset class.

Resource stocks, sometimes called “Hard Asset Stocks,” include companies that own and produce an underlying natural resource such as oil, natural gas, precious metals, base metals such as copper and nickel, coal, or even lumber. They can provide protection against inflation because their largest expenses are the purchase of extraction rights. Inflation then can’t meaningfully increase the cost of production until extraction rights expire because they’re purchased only once for a long period of time. Real estate investment trusts (REITs) are resource stocks for the same reason – their expenses were paid up front with the purchase of property and don’t inflate unless you buy more property while rental rates can increase with inflation.

Investing in resource stocks is not the same thing as investing directly in commodities. Buying gold bullion or a gold futures contract is an investment directly in raw commodities and their volatility. The optimum asset allocation to physical gold and silver is 0% since the average return is just inflation whereas the expected standard deviation (risk) is very high. A gold mining company’s profits behave differently, making it a resource stock investment.

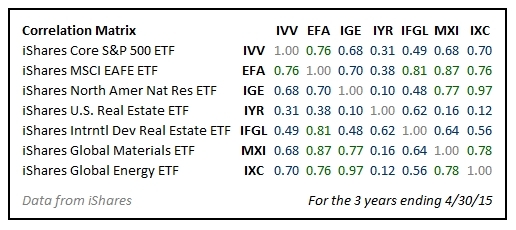

While all resource stocks provide some inflation protection, resource stocks do not always move in sync with one another. Here is the correlation between several index for the past 3 years:

This chart compares the correlation of representative resource stock indexes to US and foreign stock indexes, representing their respective asset classes. US stocks are represented by iShares Core S&P 500 ETF (IVV) and foreign stocks by iShares MSCI EAFE ETF (EFA). iShares North America Natural Resource ETF (IGE), iShares US Real Estate ETF (IYR), iShares International Developed Real Estate ETF (IFGL), iShares Global Materials ETF (MXI), and iShares Global Energy ETF (IXC) are all resource stock indexes.

The highest 3-year correlations between any of the resource stocks and US or foreign are between the iShares EAFE Index ETF (EFA) and iShares Global Materials (MXI) at 0.87 and iShares International Real Estate (IFGL) at 0.81. The rest of the resource stock indexes have an even weaker correlation to US and foreign stocks, dropping as low as 0.31 between the S&P 500 ETF (IVV) and US Real Estate (IYR).

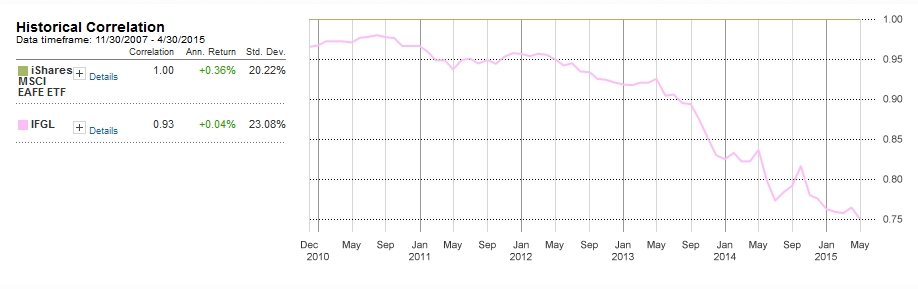

Even a correlation of 0.81 is low enough to be very useful for diversification and rebalancing. The higher correlation (for resource stocks) between the International Developed Real Estate (IFGL) and the foreign EAFE Index makes sense: real estate is a large component of the EAFE Index. Morningstar puts real estate in the “Financials Sector”, which is the largest component of the EAFE Index at 25.88%. Financials represent only 16.10% of the S&P 500, which is why the correlation between International Developed Real Estate and US stocks is only 0.47.

Here is a graph of the historical correlation between the EAFE Index and International Developed Real Estate:

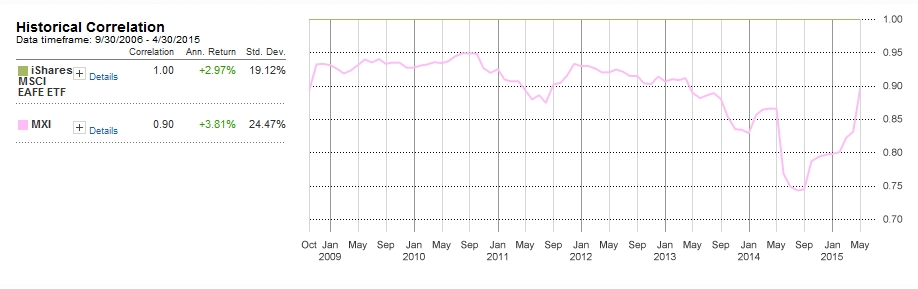

The correlation of 0.87 between the foreign EAFE Index (EFA) and iShares Global Materials ETF (MXI) is slightly higher than the 0.85 we would be looking for to assign that stock a separate asset class. This is because iShares Global Materials is 52.87% invested in chemical companies, which often have to buy raw materials to create their products. Those companies, then, are consumers of resource stock companies, negating the hedge against inflation most resource stocks provide. iShares Global Materials also contains metals, construction materials, and forest products, all of which are true resource stocks, but the chemical companies cause the ETF to move too much in sync with the EAFE Index for optimal diversification.

Here is a graph of the historical correlation between the EAFE Index and iShares Global Materials:

Besides MXI, it seems clear that resource stocks have a weak enough correlation to US and foreign stocks to consider them their own asset class.

We use the iShares North America Natural Resource ETF (IGE) and Vanguard’s US REIT (VNQ) in our Marotta Gone Fishing Portfolio to represent the resource stock asset class. VNQ is comparable to IYR because they both track US real estate indexes, but VNQ has an expense ratio of 0.12% compared to IYR’s 0.43%. As a result, we favor VNQ.

We chose these funds because, of the five resource stock indexes we looked at, IGE and IYR had the lowest correlations to both US and foreign stocks. Not only does their weak correlation to US and foreign stocks make them valuable for diversification, our chosen resource stock indexes have a 0.1 correlation with each other (VNQ and IYR are REIT indexes while IGE is all energy and materials).

Resource stocks represent one of the most interesting collections of diverse indexes. A simple allocation of IGE and VNQ provides much of the diversification benefits of including resource stocks as an asset class without overly complicating your portfolio.

Photo used here under Flickr Creative Commons.