Using appreciated stock for your charitable giving can save thousands of dollars which otherwise would have to be paid in capital gains tax. Shrewd investors use the gifting of appreciated stock to save on their taxes.

Using appreciated stock for your charitable giving can save thousands of dollars which otherwise would have to be paid in capital gains tax. Shrewd investors use the gifting of appreciated stock to save on their taxes.

Normally a gift of charitable stock must be transferred from your brokerage account directly to a charity’s stock liquidation account. Nonprofits have such an account and they have standing orders to liquidate (sell) anything which is transferred into the account and transfer the money to the charity’s bank account. This allows the charity to give this account number to donors without compromising an active account containing real assets.

This transfer directly from your account to the charity’s account works for large gifts, but is impractical for smaller gifts. There may be a sales charge to the charity when they sell the stock and there is paperwork required for every simple gift – even of small amounts.

To facilitate charitable giving, all the major custodians provide the ability to have a donor advised fund for charitable giving. This allows investors to transfer their appreciated stock into the account, getting a taxable deduction for the donation. Later, the donor (investor) can designate which charities should receive the proceeds using an interface which is similar to a bill-pay process.

Once your Donor Advised Fund has been opened, Schwab Charitable has a very straightforward process for donating appreciated stock to charity.

First, login to Schwab.com and click on your Donor Advised Fund in your accounts list. (Under Type, it will say “Charitable Gift Account.”)

On the page that loads you will see the Schwab Charitable header. On that homepage, click the large button that says “Contribute to My Account.” This will start the short process.

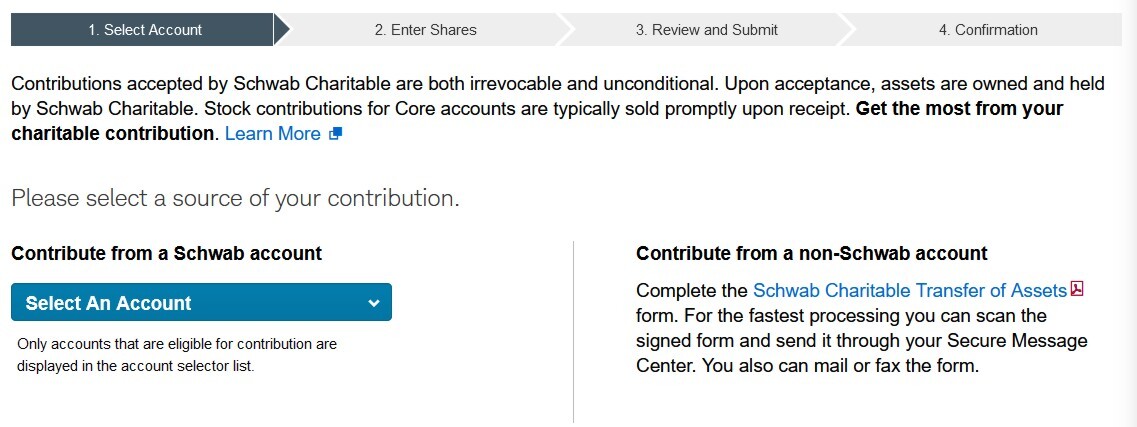

Step one is to select from which account you would like to donate.

You can select the account from the blue drop down menu. Once you have selected the account, click the green next button which appears.

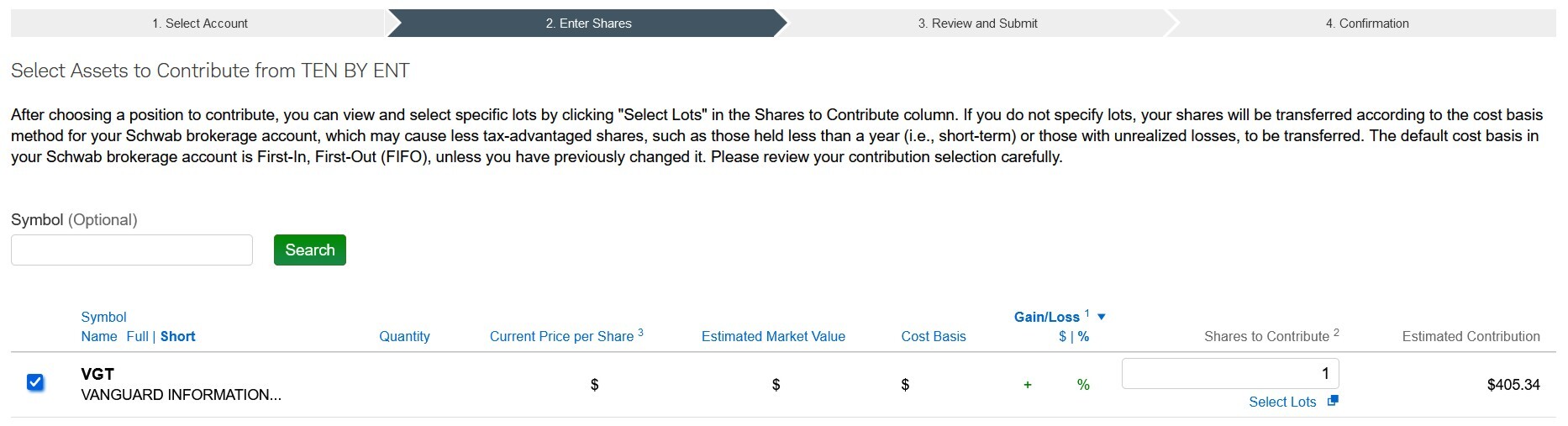

In step two, pick which shares you’d like to donate. The page that loads has a list of all the holdings in your selected account.

To the left of each security, there is a checkbox. By checking the box, you note that you would like to give from that holding’s balance.

Then, on the right you enter how many shares you would like to donate. As you change the shares, the “Estimated Contribution” amount will increase or decrease.

You can donate from more than one source by checking more boxes. At the bottom of the page it will total approximately how much you are giving.

If you have specific trade lots which you want to donate, you can click the “Select Lots” to identify out of which cost basis you want to source your gifts from that holding.

Of note: These estimates do not represent the final valuation of your gift. Later, Schwab Charitable will issue you a giving letter with the proper valuation.

Once you are finished, scroll to the bottom and click the green “Next” button.

The next page will summarize what you are giving, the “Total Estimated Contribution,” and ask you to agree to the following terms and conditions:

I authorize Charles Schwab & Co. to irrevocably and unconditionally transfer ownership of the assets specified above to Schwab Charitable. I understand that any contribution, once accepted by Schwab Charitable, is an irrevocable and unconditional contribution to Schwab Charitable and is not refundable to me for any reason. Schwab Charitable will review all contributions prior to accepting them.

I also understand that for transfers made from a Schwab account held in joint ownership, I am acting on behalf of the other registered owner(s).

In a drop down menu, you also select to which email address you’d like to receive email confirmation of your donation.

When ready, check the box “By checking the box, I acknowledge that I have read and agree with the statements above.” and click the green “Submit” button.

The last page will be a confirmation that you have donated.

Photo by Surface on Unsplash