We are pleasantly surprised by how widely popular our Schwab Tutorials are here on the Marotta On Money website. We are an independently owned and operated wealth management firm. We are not affiliated with Schwab or any other custodian. We use Charles Schwab as the primary custodian for most of our service levels.

We are pleasantly surprised by how widely popular our Schwab Tutorials are here on the Marotta On Money website. We are an independently owned and operated wealth management firm. We are not affiliated with Schwab or any other custodian. We use Charles Schwab as the primary custodian for most of our service levels.

If you’d like to read more tutorials like these, you may enjoy subscribing to our weekly newsletter.

Through a relationship with Charles Schwab, you can have access to the many convenient features the custodian provides for managing your accounts online. One of those features allows you to move cash between your Schwab accounts with just a few clicks.

I find this feature particularly helpful for moving cash between my Schwab brokerage account and my Schwab High-Yield Investor Checking Account. A portion of my paycheck is automatically deposited into my Schwab High-Yield Investor Checking Account each month. Once I have accumulated a certain balance that feels comfortable to me, I use this feature to transfer cash from my Schwab High-Yield Investor Checking Account to my Schwab brokerage account to be invested. If I find that I need a little more money in my Schwab High-Yield Investor Checking Account, I can simply sell some investments in my Schwab brokerage account and move the cash to my Schwab High-Yield Investor Checking Account.

Another convenient feature of the Schwab High-Yield Investor Checking Account is that it uses your Schwab brokerage account as a backup in case you make a purchase that exceeds the balance of your Schwab High-Yield Investor Checking Account. In this way, you don’t necessarily have to keep cash in your Schwab High-Yield Investor Checking Account in order to use the Schwab Debit Card as long as you maintain enough cash in your Schwab brokerage account to cover your expenses. If overdrawn, Schwab will automatically transfer cash from your Schwab brokerage account.

How to Move Cash Between Your Schwab Accounts

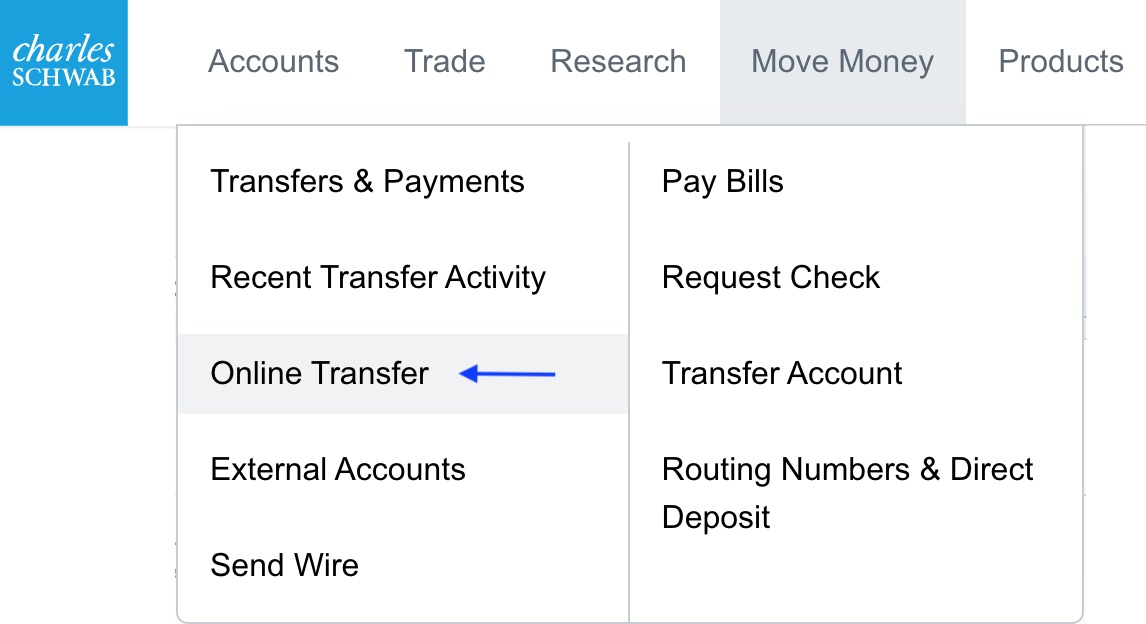

After logging in to Schwab Alliance at https://www.schwab.com, select the “Move Money” tab and click “Online Transfer”.

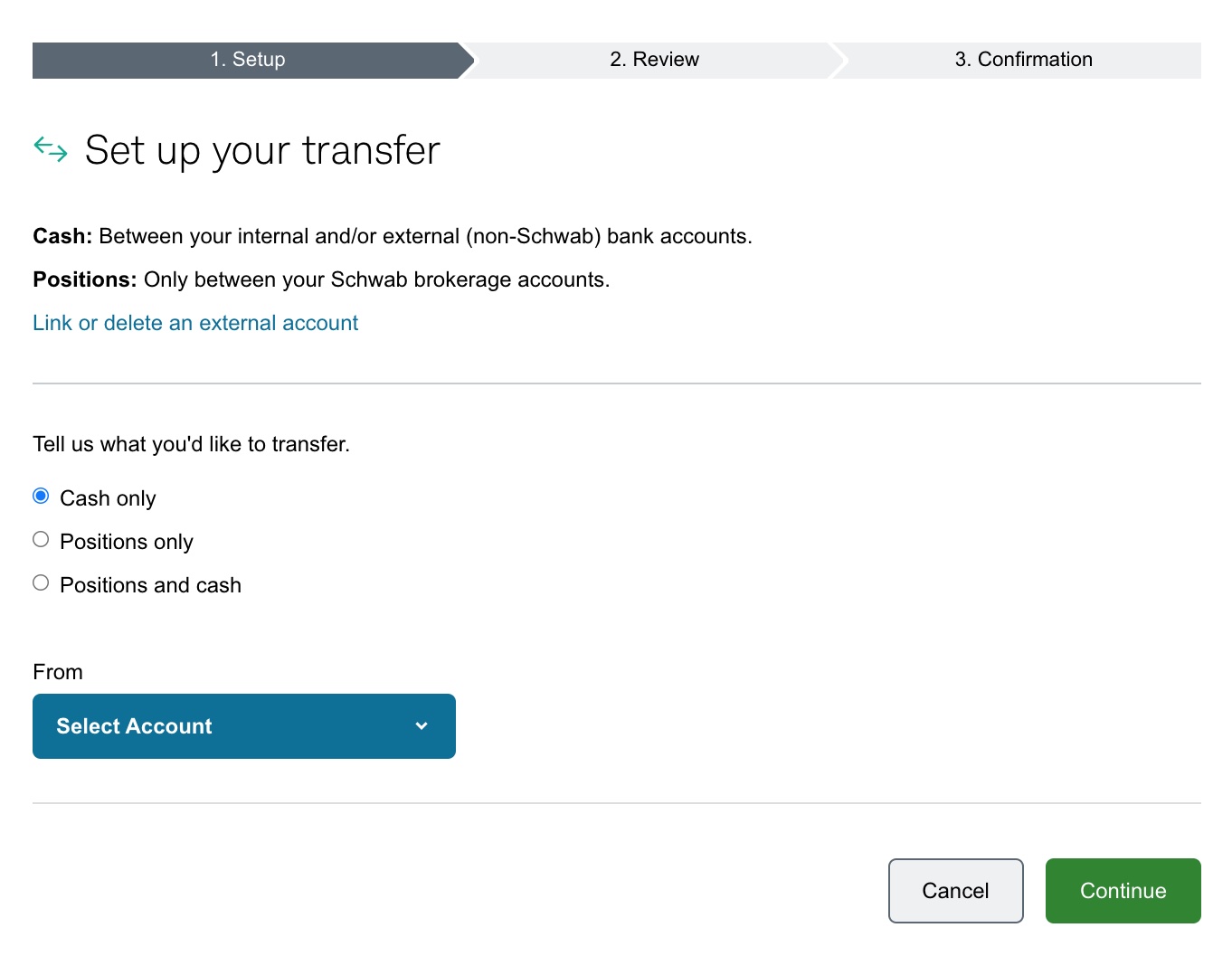

The following page will look like this:

The default option for what you’d like to transfer is “Cash Only.” If you’d like to transfer specific investment positions like stocks or bonds, you can select your desired option from the list under “Tell us what you’d like to transfer.” It’s important to note that investment positions can only be transferred between brokerage accounts like individual or joint taxable accounts. They cannot be transferred to checking accounts or retirement accounts such as traditional or Roth IRAs. Cash can be transferred between any type of account.

To transfer cash, simply verify that “Cash Only” is selected. Then select the Schwab account that you would like to move cash from in the “From” drop down menu and select the Schwab account that you would like to move cash to in the “To” drop down menu.

Once you have selected the accounts you would like to move cash to and from, the following fields will appear:

Enter the cash amount you would like to transfer and select the frequency from the drop down menu (options shown above) and the transfer date. Then click the green “Continue” button.

The next page will ask you to review and submit your transfer. When you have confirmed that the information is correct select the green “Submit” button to complete your transfer.

You will then receive a message saying, “Your transfer request(s) has been successfully submitted” on the next page. There will also be a link to “Request Another Transfer or View/Edit Transfers.”

You can find a quick walk through of this process in a Schwab tutorial video under Transfers and Payments after you login to Schwab.com. As always, if you need help with the Schwab website, you can call Schwab Alliance at 800-515-2157 or message them via the message center.

Photo by Peter Olexa on Unsplash