In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management using Schwab’s Institutional Intelligent Portfolios (IIP), an automated investment management platform. Some additional services are available for an additional charge.

In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management using Schwab’s Institutional Intelligent Portfolios (IIP), an automated investment management platform. Some additional services are available for an additional charge.

In order to move funds between a non-Schwab account (external account) and your Schwab account, you simply need to establish what is called a MoneyLink. After the MoneyLink is established, you can easily move funds online between the two accounts.

There are two ways to establish the MoneyLink, one through the Schwab IIP site and the other through the Schwab Alliance site. They both accomplish the same end.

If you wish to use the Schwab IIP site, you can do a similar process by clicking on the “Add/Withdraw Money” menu option and then selecting “Link an external bank account” and following the instructions.

Here is how to accomplish the task via Schwab Alliance.

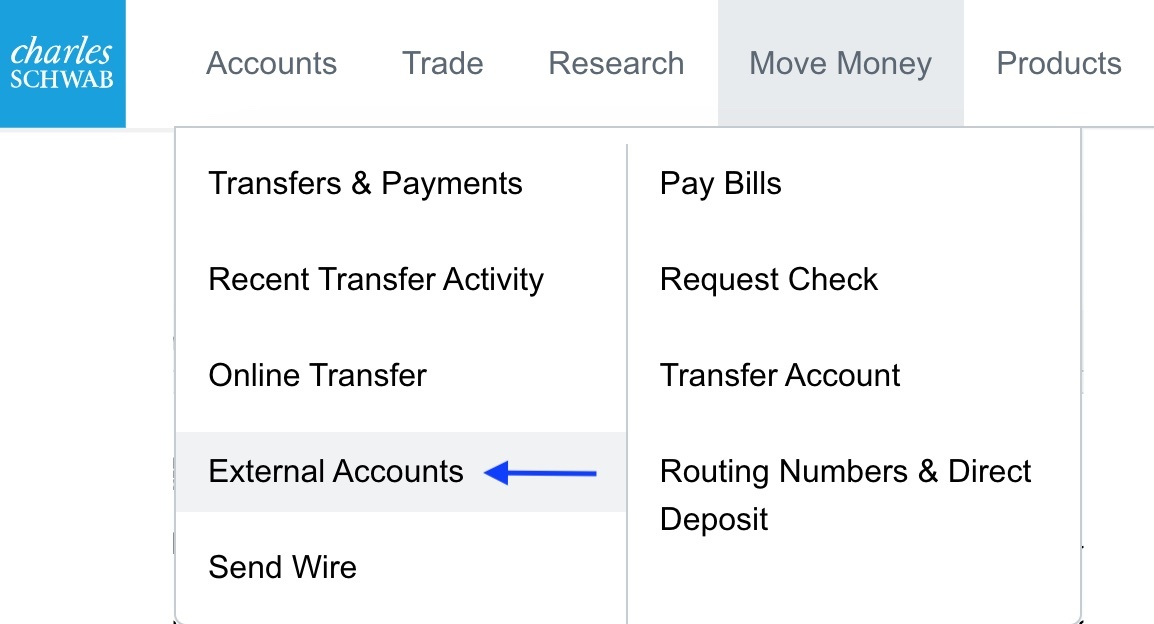

After logging in to Schwab Alliance at https://www.schwab.com, click on the “Move Money” tab at the top and select “External Accounts”.

You may see the message “Online management of existing external account information is not currently available for this type of account,” but that is likely because you haven’t selected an account yet.

On the page that loads, click “Add Account.” Then, select the account you would like to link the external account to from the dropdown menu below “Your Schwab accounts” on the next page.

If you are selecting a retirement account such as a Roth IRA, you will see the message “Only incoming requests can be created for this account when enrolling online.” If you need to establish an outbound MoneyLink for an IRA, you will need to download and complete a Request an IRA Distribution form which is shown as “IRA distributions” under the list of downloadable forms on the page. After signing the form, you can find instructions for returning the form to Schwab towards the bottom of the form.

Otherwise, the next step is to check the box indicating that you have the authority to submit the enrollment request and click the green “Continue” button.

The next page explains how Schwab uses your login credentials to verify that you are the legal owner of the non-Schwab account. It also describes an alternative method of verifying that you are the legal owner if you are unable or do not wish to provide your login credentials. After reading that page, click the green “Continue” button.

The next page will prompt you to select the financial institution where your external account is held. If you don’t see your financial institution, simply type in the name of your financial institution in the search box provided.

You will then need to enter your login credentials for your financial institution or input the routing number and account number for the external account you are trying to link. Select the type of account (checking or savings) from the drop down menu. Click continue.

You will then be prompted to login again to verify your account. If you do not enter the correct username and password, you will need to use the alternate verification method of Trial Deposits, so be sure to type your login carefully.

Check the agreement box under “Acceptance of the Schwab MoneyLink® Terms and Conditions and the Use of Electronic Records and Signatures” and click “Verify Account.”

After the MoneyLink is established, this external account will appear in the list of accounts available for transfer in the “Online Transfer” page.

As always, if you need help with the Schwab website, you can call Schwab Alliance at 800-515-2157 or message them via the message center.

Photo by Lilly Rum on Unsplash