Whenever you have significant losses in a taxable account, you should consider tax loss harvesting, selling those losses as a part of tax planning and then buying a placeholder security for 30 days.

Capital losses can offset capital gains or can give you a capital loss which you can report on your tax return. Up to $3,000 of losses each year can be taken as a deduction to reduce ordinary income each year. Capital losses which are not used in one year can be carried forward indefinitely to be used in future years.

The Internal Revenue Service (IRS) prohibits a taxpayer from claiming the loss on their taxes if they buy a substantially identical security within 30 days before or after the sale. Selling Apple stock on Monday and buying it back on Friday, for example, triggers the wash sale rules. In that case, the loss which you attempted to realize on Monday must be applied to the cost basis of the stock purchased on Friday, giving you none of the capital loss benefits.

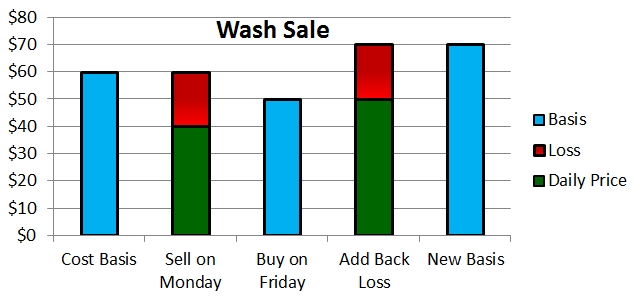

As an example, suppose you owned stock with a cost basis of $60 per share and sold it for a loss at $40 per share. The stock starts to move back up and you repurchase it too quickly at $50 per share. Instead of receiving a $20 per share realized capital loss you would have to assume a cost basis on your new stock of $70 so that you have transferred the loss to your new purchase.

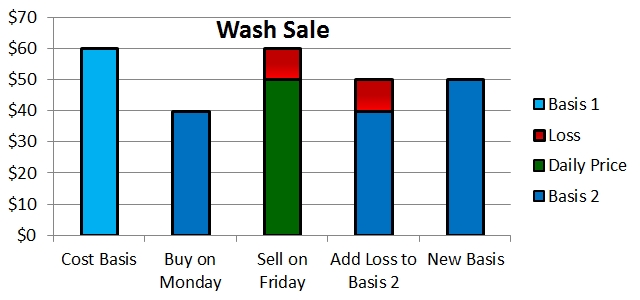

Something similar happens when you purchase a stock on Monday and then try to sell an identical position for a loss on Friday.

As an example, suppose you owned stock with a cost basis of $60 per share. On Monday you purchase a similar position at a cost of $40 per share. Then the stock price rises to $50 per share. On Friday you sell the first position for what is now a $10 per share loss. Instead of receiving a $10 per share realized capital loss, you would have to add that back to the cost basis of the stock purchased on Monday. Monday’s purchase would now have a cost basis of $50 per share and coincidentally be trading at $50 per share. The $10 unrealized gain would be negated by the $10 transferred loss from the wash sale.

The computation of wash sale cost basis adjustments can be complex to follow.

That being said, the stock of one company is not “substantially identical” to stock in a different company, regardless of the two companies. However, contracts or options on a stock are considered substantially identical to the stock itself, and preferred stock which is convertible into common stock without any restrictions may also be considered substantially identical.

To avoid the wash sale rules while still harvesting the gains, you could just wait the 30 days to buy the security back. However, when a position has a loss can be one of the worst times to miss being invested in it. Assuming it is part of a brilliant investment plan, you would like to realize the loss and still remain invested in it or something very similar to experience any rebound that may occur.

There are several ways to remain invested in something which is very similar but not substantially identical.

At Schwab, wash sales are computed automatically and cost basis adjusted for securities which have identical symbols. For securities which have different symbols they assume that such investments are not substantially identical.

Early on, we wrote an article on the fund selection choice between iShares MSCI Emerging Markets ETF (EEM) and the Vanguard FTSE Emerging Markets ETF (VWO). Both are good choices and their returns are extremely highly correlated.

While the investments are very similar, they are not substantially identical. They follow two different emerging markets indexes. The number of holdings differs by 177 stocks. One invests 14% in South Korea and the other one invests nothing. One expense ratio is over four times that of the other.

While the IRS has never issued a ruling, I am comfortable stating that for any of these reasons the two funds are not “substantially identical.” The wash sale rules were written prior to the advent of mutual funds and exchange trade funds and the IRS has never pursued investors for changing investments which have some overlap of underlying funds.

For this reason, it is nice to have two different investments for each sector of your asset allocation. You can sell EEM for a tax loss and buy VWO the same day to remain invested in the sector.

Investments which are similar enough to stay invested do not have to be as similar as EEM and VWO. Any fund with a relatively high correlation will help maintain investment returns for the 31 day wash sale waiting period.

But what if you prefer one investment selection for a category above all the others? In this case, you have to wait 31 days between your buy and sell. You have two options. First, you could sell the original position for a loss and allow the proceeds to wait for 31 days out of the markets until you can buy back into the identical position. Or second, you can buy more of the position and have twice what you would normally have for 31 days before you sell the original position for a loss.

Wash sale rules need to be followed when realizing capital losses for taxes. They can be burdensome to track and monitor when you are trading on your own and are therefore another way an investment advisor can add value to your portfolio management.

Photo used here under Flickr Creative Commons.