Portfolio Rebalancing Boosts Returns

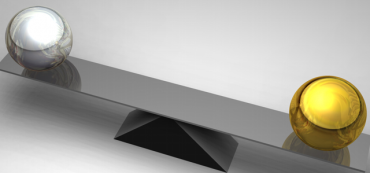

Rebalancing your investments can help boost your returns and minimize risk. This simple contrarian move can help you compound your investment gains over time. With the markets at an all-time high, this may be a good time to rebalance your portfolio.