Even the most brilliantly crafted investment plan has to be given time to work. The markets are inherently volatile but also inherently profitable. And when you start investing in the markets you are very likely to see many highs and lows as the market gyrates before you see permanent gains.

And since asset allocation involves crafting a portfolio out of many sectors which have low correlation, one component of your portfolio certainly will experience an early loss. Diversification means you will always have something to complain about.

Perhaps the most important part of implementing an investment plan is the wisdom to know when one category doing poorly means you should do something and when it means nothing.

We know from behavioral finance that many people give up on a brilliant investment philosophy too soon. They chase returns rather than rebalancing.

And we know from studies on mutual fund flows that investors underperform the very mutual funds they are invested in because they buy funds after they have gone up and they sell funds after they have gone down.

We don’t want to be the foolish investor who sells at the bottom only to reinvest at the top of the next bubble.

Here is the primary question to help you discriminate between a brilliant investing strategy and a mistake:

Do you have sufficient data to justify the long term mean returns you want?

It is a mistake to select an investment sector based on recent returns. In order to get meaningful statistics, you need to use the longest time horizon possible.

Even 30 years is not long enough to judge which investment will have a higher mean return for the next 30 years. For example, we recently had a 30-year time period where long term bond returns beat the return for stocks .

Periodically, it is wise to reevaluate your investment selection to see if you made a mistake. You may have been enamored by the ability of a fund manager to select stocks. You may have thought a fund was worth higher fees and expenses. You may not even have understood what you were investing in. You may have invested in something that has a low or even negative mean return. Or you may have invested in an illiquid asset.

If you do find a mistake, it is always a good time to sell a bad investment. There is no reason to “wait for a rebound,” because a better investment will on average rebound better for you.

During the portfolio construction process, look for sectors with a high expected return, a low volatility, and a low correlation with other components of your portfolio. Then, when you experience the volatility ask yourself if it behaved as you expected.

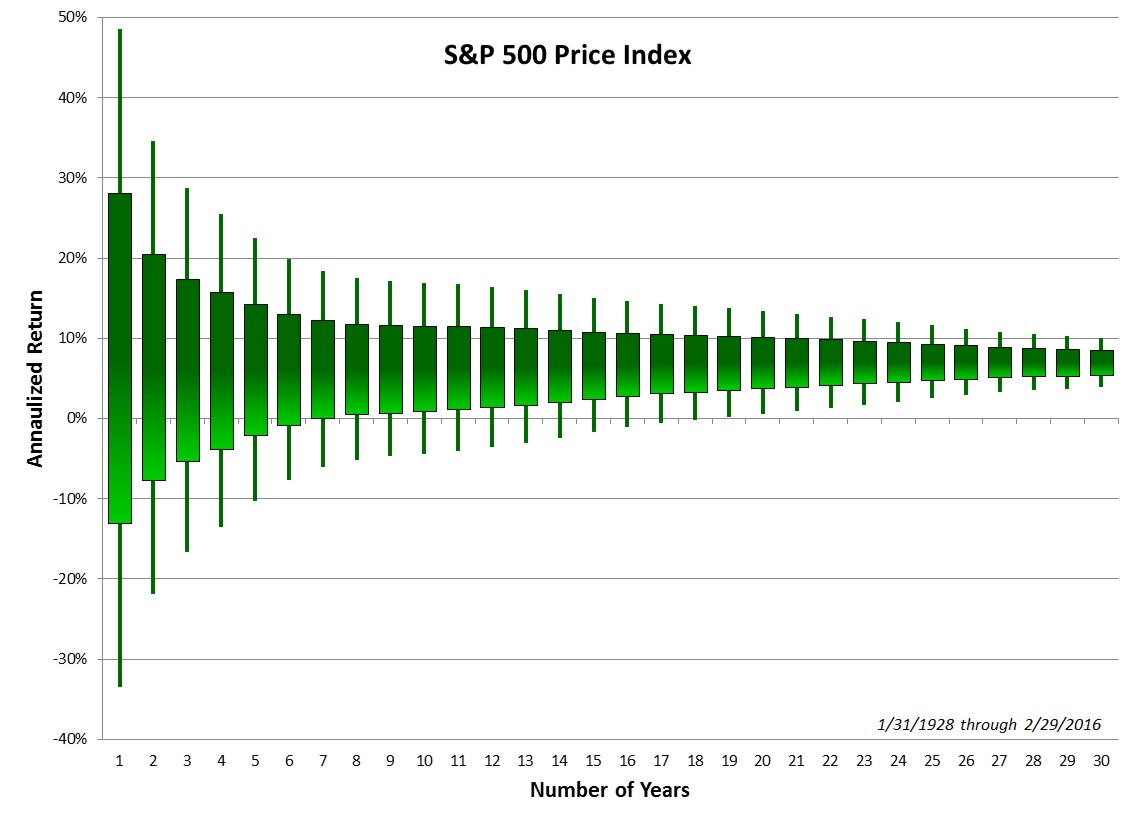

Imagine that you have invested in a fund tracking the S&P 500 Price Index and it quickly experienced over two-years an -19% annualized loss. Wondering if you made a mistake, you ask yourself, did your experience fit what your data expected?

To answer this question, you look at the range of returns experienced by the S&P 500 Price Index since 1928 (all the data we have).

The mean return (not including dividends) is about 7%. In the graph below, you can see this as the graph funnels around a 7% return the longer the number of years.

The thick bars are 1-standard deviation from that mean; the thin bars are two standard deviations.

Returns within one or two standard deviations are commonplace returns. The data doesn’t just expect these it predicts them.

Within one standard deviation of the mean are approximately two out of every three returns experienced. Meanwhile, approximately 22 out of every 23 returns are within two standard deviations.

As you can see, it depends on the number of years how wide the range of predicted annualized returns. Over a one-year time period, one standard deviation from the mean is from -13.00% to 28.07%. Meanwhile, over a thirty-year time period, one standard deviation from the mean is 5.45% to 8.53%.

Two standard deviations for one-year time periods is -33.53% to 48.06% and for thirty-year time periods it is 3.91% to 10.08%.

When you look at two-year time periods, the two-standard-deviation set of returns is from -21.81% to 34.56%. The return you experienced, -19%, falls in this time period, making it commonplace. Your data not only expected it, your data predicted it.

Despite one, two, and three-year time periods all having moderate annualized losses within one-standard deviation, for the S&P 500 Price Index at a 7-year holding period the bottom of the one-standard deviation range (2 out of every 3 returns experienced) rises above zero to a positive 0.02%.

The bottom of the two-standard deviation range (22 out of every 23 returns) rises above zero after a 19-year period.

Even good indexes which are part of a carefully crafted portfolio on the efficient frontier have a bad decade. Get rid of them at the low and you are liable to miss the recovery as the index returns revert to the mean and have some greater than average growth.

And while individual stocks can go to zero, broad indexes cannot. To ensure this fact, your funds should be comprised of a large number of holdings. There is no such thing as over diversification. A large number of holdings helps ensure that the category is worth a place in your asset allocation for the long term even when returns are below average for a period of time.

There are reasons to remove a sector from your asset allocation, but not simply for returns that are below average.

The opposite is true however. When a category experiences rapid appreciation, investors piling in may cause the price to rise faster than the expected earnings. A higher than normal forward P/E ratio can be an indicator of lower than expected future returns. Dynamic asset allocation would suggest trimming the allocation to sectors with a higher forward P/E ratio so that when the sector reverts to the mean, you have less experiencing the fall.

Sometimes even a good investment can drop precipitously.

Approximately 1 out of every 23 times the stock market will experience returns greater than two standard deviations from the mean.

The markets are more abnormal than a normal Gaussian bell curve. This non-Gaussian mathematics is called Power Laws and forms the basis for fractals.

Stock returns experience 4 or more standard deviations greater than normal statistics would predict. Gaussian statistics experience greater than 3 standard deviations approximately 0.2% of the time whereas the stock market experiences greater than 3 standard deviations approximately 0.56% of the time .

When returns are outside of two standard deviations the same analysis applies, but the hype from the financial news media is terrifying.

The worst 12-month return for the S&P 500 was -70.13% (a 4-standard deviation loss) and ended June 30, 1932. The best 12-month return ended just 12-months later and was 146.28% (a 7-standard deviation gain).

I take comfort in the fact that unusually large drops are often followed by unusually large gains. A similar pairing happened during the crash of 2008.

The 12-months prior to 2/28/2009 experienced a -44.76% drop (a 3-standard deviation loss). The next 12 months appreciated 50.25% (a 3-standard deviation gain).

For the most part, short term returns should not ruin a brilliant long term investment strategy. Normally it is best to rebalance your portfolio selling what has gone up and buying what has gone down. If you can’t stomach rebalancing your portfolio, at least don’t lose heart and abandon the plan.

Photo used here under Flickr Creative Commons.