Trending Now

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 (53)

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 (53) States with Tax-Exempt Interest from U.S. Debt Obligations June 17, 2022 (46)

States with Tax-Exempt Interest from U.S. Debt Obligations June 17, 2022 (46) Do Children Need To File A Tax Return To Fund Their Roth IRA? (2020) May 25, 2020 (21)

Do Children Need To File A Tax Return To Fund Their Roth IRA? (2020) May 25, 2020 (21) Two Financial Planning Strategies For Business Owners March 25, 2025 (2)

Two Financial Planning Strategies For Business Owners March 25, 2025 (2) How to Calculate Fair Market Value if the Date of Death Is on a Weekend? October 14, 2022 (8)

How to Calculate Fair Market Value if the Date of Death Is on a Weekend? October 14, 2022 (8) How to Claim Your Virginia State Tax 529 Contribution Deduction July 31, 2020 (8)

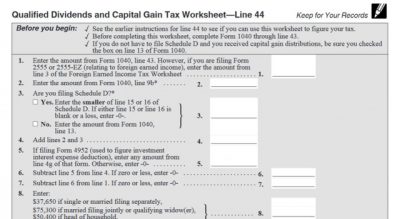

How to Claim Your Virginia State Tax 529 Contribution Deduction July 31, 2020 (8) How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet September 24, 2021 (20)

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet September 24, 2021 (20) Comparing Vanguard Total Market Fund Strategies (VT vs. VTI and VXUS) November 26, 2024 (7)

Comparing Vanguard Total Market Fund Strategies (VT vs. VTI and VXUS) November 26, 2024 (7) How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet August 9, 2021 (15)

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet August 9, 2021 (15) Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 (6)

Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 (6) Changes to RMDs for Those Born in 1951 or Later (Secure 2.0) January 31, 2023 (7)

Changes to RMDs for Those Born in 1951 or Later (Secure 2.0) January 31, 2023 (7) Charles Schwab: How to Order More Checks or Deposit Slips (2022 Update) September 9, 2022 (8)

Charles Schwab: How to Order More Checks or Deposit Slips (2022 Update) September 9, 2022 (8) Protect Yourself By Silencing Unknown Callers (Android) November 12, 2024 (3)

Protect Yourself By Silencing Unknown Callers (Android) November 12, 2024 (3)

All Time Most Popular

What is a 1031 Real Estate Exchange? May 31, 2014 Despite their complexity, these exchanges have the potential to save vast amounts of money. (100,628)

What is a 1031 Real Estate Exchange? May 31, 2014 Despite their complexity, these exchanges have the potential to save vast amounts of money. (100,628) How to Avoid the Vehicle Sales Tax in Virginia November 27, 2012 "I would like to give my daughter my newer car, but the tax considerations are not simple." (96,093)

How to Avoid the Vehicle Sales Tax in Virginia November 27, 2012 "I would like to give my daughter my newer car, but the tax considerations are not simple." (96,093) Can I Contribute to Both a SEP and a 401(k)? June 1, 2016 SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do. (75,775)

Can I Contribute to Both a SEP and a 401(k)? June 1, 2016 SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do. (75,775) The Complete Guide to Your Washing Machine July 23, 2013 The complete guide to saving money while washing your clothes. What temperature should the water be? What cycle should I use? What detergent should I use? (67,719)

The Complete Guide to Your Washing Machine July 23, 2013 The complete guide to saving money while washing your clothes. What temperature should the water be? What cycle should I use? What detergent should I use? (67,719) Q&A: Can I Use 529 Funds for Off-Campus Housing? November 13, 2018 In general, you can use 529 funds to pay for your student’s off-campus housing costs. (67,050)

Q&A: Can I Use 529 Funds for Off-Campus Housing? November 13, 2018 In general, you can use 529 funds to pay for your student’s off-campus housing costs. (67,050) How to Transfer Your Economic Impact Payment Card Into Your Bank Account May 29, 2020 It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time. (64,498)

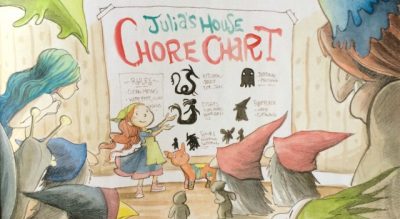

How to Transfer Your Economic Impact Payment Card Into Your Bank Account May 29, 2020 It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time. (64,498) Fund Your Child’s Roth with Chore Income April 23, 2019 There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. (52,435)

Fund Your Child’s Roth with Chore Income April 23, 2019 There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. (52,435) Why is Bob Cratchit So Poor? December 12, 2005 At first glance, this story fills us with pity for the Cratchit family, always struggling to make ends meet. But is that the true story? (48,772)

Why is Bob Cratchit So Poor? December 12, 2005 At first glance, this story fills us with pity for the Cratchit family, always struggling to make ends meet. But is that the true story? (48,772) Charles Schwab: How to Order More Checks or Deposit Slips September 22, 2018 With Schwab Bank, any time you need more checks or deposit slips you can simply request them for free. (47,832)

Charles Schwab: How to Order More Checks or Deposit Slips September 22, 2018 With Schwab Bank, any time you need more checks or deposit slips you can simply request them for free. (47,832) How to Lower Your AGI and Why You’d Want To July 26, 2017 Here are 8 reasons you'd want to lower your AGI and 8 methods to lower your AGI. (46,585)

How to Lower Your AGI and Why You’d Want To July 26, 2017 Here are 8 reasons you'd want to lower your AGI and 8 methods to lower your AGI. (46,585) Funding a 3-Year-Old’s Roth IRA March 27, 2020 My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time. (44,256)

Funding a 3-Year-Old’s Roth IRA March 27, 2020 My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time. (44,256) How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits. (41,118)

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits. (41,118) Charles Schwab: How to Fund Your Account with a Check September 27, 2018 If you are doing a one-time funding from another account, sometimes the lowest tech option can be the easiest. (37,751)

Charles Schwab: How to Fund Your Account with a Check September 27, 2018 If you are doing a one-time funding from another account, sometimes the lowest tech option can be the easiest. (37,751) How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet May 16, 2017 The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. (35,729)

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet May 16, 2017 The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. (35,729) Q&A: Can a 529 Reimburse for Last Year’s Expenses? September 15, 2020 Unfortunately, neither "yes" nor "no" is a correct answer to this question. (34,748)

Q&A: Can a 529 Reimburse for Last Year’s Expenses? September 15, 2020 Unfortunately, neither "yes" nor "no" is a correct answer to this question. (34,748) Mailbag: Should I Pay Off My Mortgage Early? April 13, 2012 Some say don't make extra payments, take the tax deduction. Others say you need to be debt free. (34,318)

Mailbag: Should I Pay Off My Mortgage Early? April 13, 2012 Some say don't make extra payments, take the tax deduction. Others say you need to be debt free. (34,318)

Popular from This Year

The Right Day to Distribute Your RMD Monthly February 11, 2025 If you want to take our word for it, you can schedule your monthly RMD for the 8th. If you are curious as to the calendar math that suggests this date, read on. (2,631)

The Right Day to Distribute Your RMD Monthly February 11, 2025 If you want to take our word for it, you can schedule your monthly RMD for the 8th. If you are curious as to the calendar math that suggests this date, read on. (2,631) Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 Furthermore, it is difficult for clients to locate the full account number through simple clicking around the online portal. Instead, you have to know where to look. (2,610)

Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 Furthermore, it is difficult for clients to locate the full account number through simple clicking around the online portal. Instead, you have to know where to look. (2,610) Comparing Vanguard Total Market Fund Strategies (VT vs. VTI and VXUS) November 26, 2024 By adding a little complexity and blending a portfolio of VTI and VXUS, you create the opportunity for three layers of benefits. (2,341)

Comparing Vanguard Total Market Fund Strategies (VT vs. VTI and VXUS) November 26, 2024 By adding a little complexity and blending a portfolio of VTI and VXUS, you create the opportunity for three layers of benefits. (2,341) How to See Your Schwab RMD Online (2024 Update) July 9, 2024 On June 2024, Schwab provided an update about viewing and taking your RMD on Schwab.com. (1,582)

How to See Your Schwab RMD Online (2024 Update) July 9, 2024 On June 2024, Schwab provided an update about viewing and taking your RMD on Schwab.com. (1,582) How to Calculate Your Own Safe Spending Rate August 20, 2024 We have attempted in this article to provide generic guidance on the topic of calculating your own safe spending rate. (1,423)

How to Calculate Your Own Safe Spending Rate August 20, 2024 We have attempted in this article to provide generic guidance on the topic of calculating your own safe spending rate. (1,423) How to Implement a DPOA at Schwab July 16, 2024 Estate planning is a task which is never useful until it is too late to do it. (1,374)

How to Implement a DPOA at Schwab July 16, 2024 Estate planning is a task which is never useful until it is too late to do it. (1,374)

This Quarter

The Right Day to Distribute Your RMD Monthly February 11, 2025 (2,631)

The Right Day to Distribute Your RMD Monthly February 11, 2025 (2,631) Q&A: What is Your Client’s Average Portfolio Size and Life Stage? (2025 Update) January 14, 2025 (754)

Q&A: What is Your Client’s Average Portfolio Size and Life Stage? (2025 Update) January 14, 2025 (754) Election Cycle Sentiments are Unlikely to Produce Long-Term Returns December 31, 2024 (400)

Election Cycle Sentiments are Unlikely to Produce Long-Term Returns December 31, 2024 (400) Professionals Agree: Having a Fee-Only Advisor Matters February 25, 2025 (386)

Professionals Agree: Having a Fee-Only Advisor Matters February 25, 2025 (386) Bank Fraud Texts: Service or Scam? January 7, 2025 (362)

Bank Fraud Texts: Service or Scam? January 7, 2025 (362) Did My Lump Sum Rollover Mess Up My Backdoor Roth? March 11, 2025 (353)

Did My Lump Sum Rollover Mess Up My Backdoor Roth? March 11, 2025 (353)